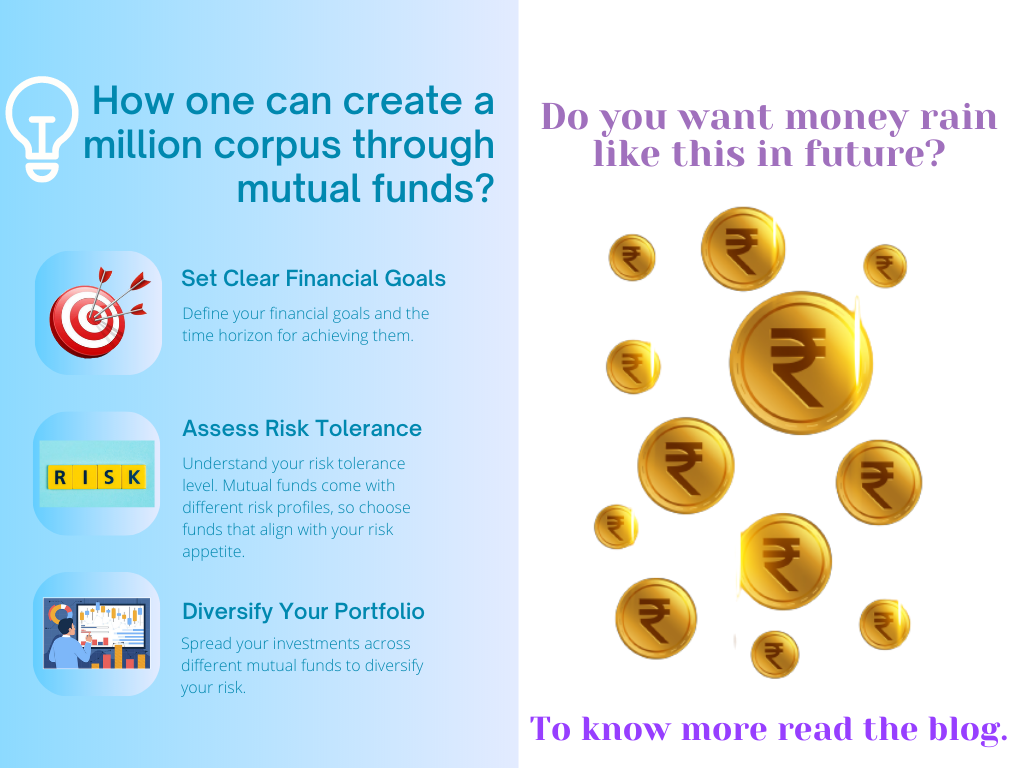

How one can create a million corpus through mutual funds?

Creating a million-dollar corpus through mutual funds requires a disciplined approach, consistent investing, and a long-term perspective. Here are some steps to help you achieve this goal:

Set Clear Financial Goals: Define your financial goals and the time horizon for achieving them. This will help you determine the appropriate investment strategy and asset allocation.

Assess Risk Tolerance: Understand your risk tolerance level. Mutual funds come with different risk profiles, so choose funds that align with your risk appetite. Generally, higher-risk funds have the potential for higher returns but may also experience greater volatility.

Diversify Your Portfolio: Spread your investments across different mutual funds to diversify your risk. Consider investing in funds across different asset classes such as equity funds, debt funds, and balanced funds. Diversification helps reduce the impact of any individual fund's underperformance.

Start Early and Invest Regularly: The power of compounding works best when you start investing early and consistently. Aim to invest a fixed amount regularly, regardless of market conditions. This approach, known as systematic investment planning (SIP), allows you to buy more units when prices are low and fewer units when prices are high, reducing the impact of market volatility.

Select High-Quality Funds: Research and choose mutual funds with a consistent track record of good performance, experienced fund managers, and a strong investment philosophy. Look for funds with low expense ratios and a reliable history of generating returns.

Monitor and Rebalance: Regularly review the performance of your mutual funds and ensure they align with your goals. If necessary, rebalance your portfolio by selling some units from outperforming funds and buying units in underperforming funds to maintain your desired asset allocation.

Be Patient and Stay Invested: Building a million-dollar corpus takes time. Stay invested for the long term, ignoring short-term market fluctuations. Avoid making impulsive decisions based on market news or temporary setbacks.

Seek Professional Advice if Needed: If you are unsure about selecting the right funds or managing your investments, consider consulting a financial advisor who can provide personalized guidance based on your financial situation and goals.

Remember, while mutual funds can potentially help you achieve your financial goals, they come with inherent risks. It's essential to educate yourself, diversify your investments, and make informed decisions based on your risk tolerance and investment horizon.