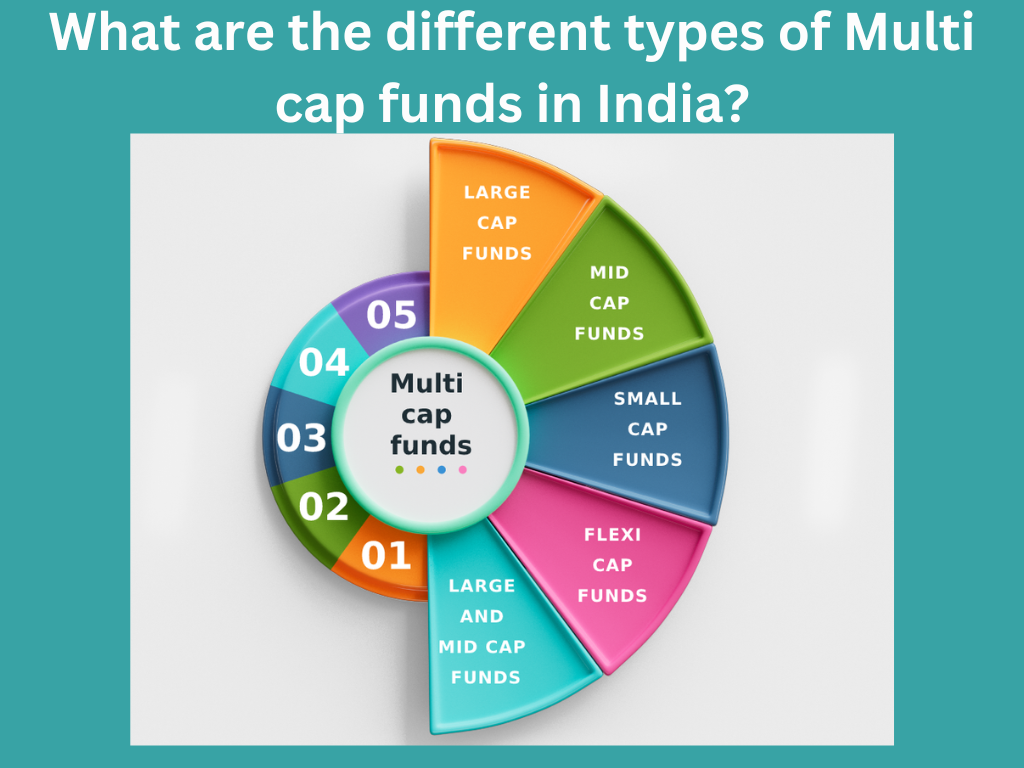

What are the different types of Multi cap funds in India?

Multi-cap funds in India are mutual funds that invest in stocks across different market capitalization segments, including large-cap, mid-cap, and small-cap companies. The fund manager has the flexibility to invest in companies across market capitalization segments, based on the investment objective of the fund. Here are some of the different types of multi-cap funds available in India:

Large-cap multi-cap funds: Large-cap multi-cap funds invest a significant portion of their assets in large-cap companies. Large-cap companies are those that have a market capitalization of Rs 20,000 crore or more. These companies are considered to be the most stable and well-established companies in the stock market. Investing in large-cap multi-cap funds can provide stability to your portfolio, as these companies have a proven track record of delivering consistent returns over the long term.

Mid-cap multi-cap funds: Mid-cap multi-cap funds invest a significant portion of their assets in mid-cap companies. Mid-cap companies are those that have a market capitalization between Rs 5,000 crore and Rs 20,000 crore. These companies are typically more volatile than large-cap companies, but they also have the potential to deliver higher returns over the long term. Investing in mid-cap multi-cap funds can help diversify your portfolio and provide exposure to companies with high growth potential.

Small-cap multi-cap funds: Small-cap multi-cap funds invest a significant portion of their assets in small-cap companies. Small-cap companies are those that have a market capitalization of less than Rs 5,000 crore. These companies are typically riskier than large-cap and mid-cap companies, but they also have the potential to deliver higher returns over the long term. Investing in small-cap multi-cap funds can provide exposure to companies with high growth potential, but it's important to remember that these funds are more volatile and should be approached with caution.

Flexi-cap multi-cap funds: Flexi-cap multi-cap funds are a newer type of multi-cap fund in India. These funds have the flexibility to invest in companies of all sizes, depending on market conditions. This means that the fund manager can adjust the allocation between large-cap, mid-cap, and small-cap companies based on their analysis of the market. Investing in flexi-cap multi-cap funds can provide the benefits of diversification across all market caps, while also taking advantage of market opportunities.

Open-ended multi-cap funds: These are mutual funds that allow investors to enter or exit the fund at any time. Open-ended multi-cap funds are popular among investors as they offer liquidity and flexibility.

Close-ended multi-cap funds: These are mutual funds that have a fixed maturity date, typically ranging from 3 to 7 years. Close-ended multi-cap funds are less popular among investors as they offer less liquidity and flexibility.

Dividend yield multi-cap funds: These are multi-cap funds that invest in stocks of companies that pay high dividends. Dividend yield multi-cap funds are ideal for investors who want regular income from their investments.

Value multi-cap funds: These are multi-cap funds that invest in stocks of companies that are undervalued or have a lower price-to-earnings ratio. Value multi-cap funds are suitable for investors who want to invest in companies with growth potential.

Contra multi-cap funds: These are multi-cap funds that invest in stocks that are out of favor with the market or are undervalued. Contra multi-cap funds are suitable for investors who want to take a contrarian approach to investing.

It is important to note that multi-cap funds offer investors a diversified portfolio of stocks across different market capitalization segments. However, the risk associated with multi-cap funds is generally higher than large-cap funds due to exposure to mid-cap and small-cap companies. It is advisable to consult with a financial advisor before investing in multi-cap funds.