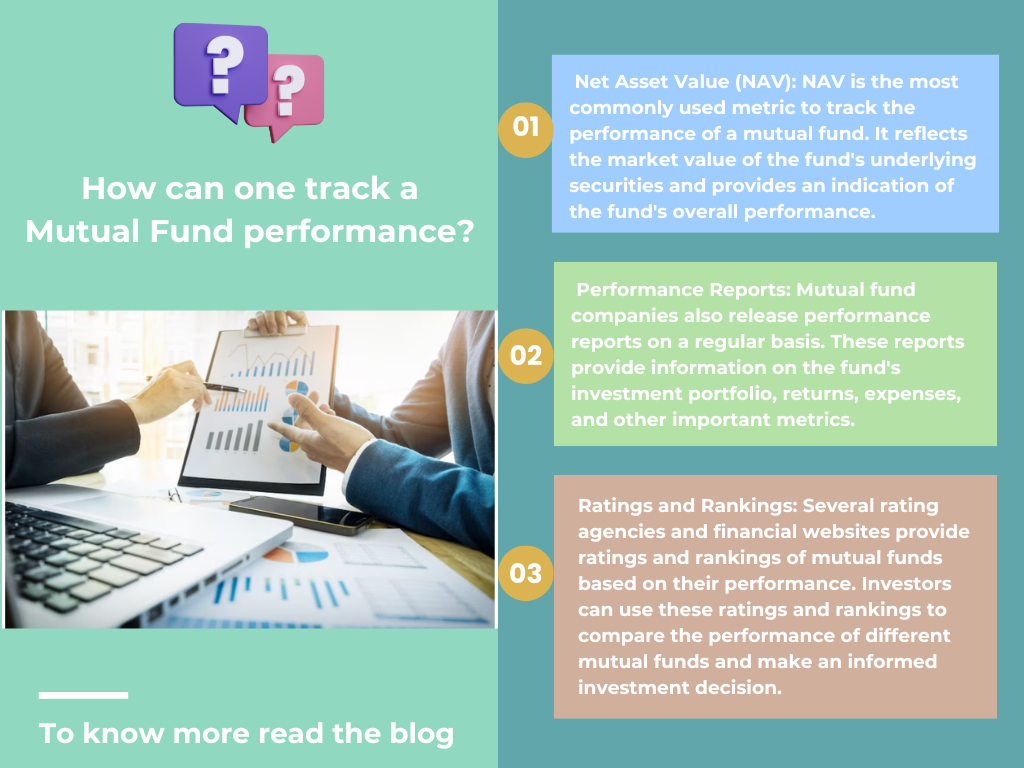

How can one track a Mutual Fund performance?

There are several ways to track the performance of a mutual fund:

Net Asset Value (NAV): NAV is the most commonly used metric to track the performance of a mutual fund. It reflects the market value of the fund's underlying securities and provides an indication of the fund's overall performance. Investors can check the NAV of a mutual fund on the mutual fund company's website or through financial news websites.

Performance Reports: Mutual fund companies also release performance reports on a regular basis. These reports provide information on the fund's investment portfolio, returns, expenses, and other important metrics. Investors can access these reports on the mutual fund company's website or through financial news websites.

Ratings and Rankings: Several rating agencies and financial websites provide ratings and rankings of mutual funds based on their performance. Investors can use these ratings and rankings to compare the performance of different mutual funds and make an informed investment decision.

Historical Data: Investors can also track the historical performance of a mutual fund by analyzing its returns over different periods, such as 1 year, 3 years, 5 years, or 10 years. This information is usually available on the mutual fund company's website or through financial news websites.

Fund Manager Interviews: Investors can also gain insights into a mutual fund's performance by reading interviews with the fund manager. These interviews provide information on the fund manager's investment philosophy, strategy, and outlook.

It's important to note that past performance of a mutual fund is not a guarantee of future results. Therefore, investors should carefully evaluate a mutual fund's investment objectives, risks, and performance before making an investment decision.