In mutual funds are Equity Funds risk-free?

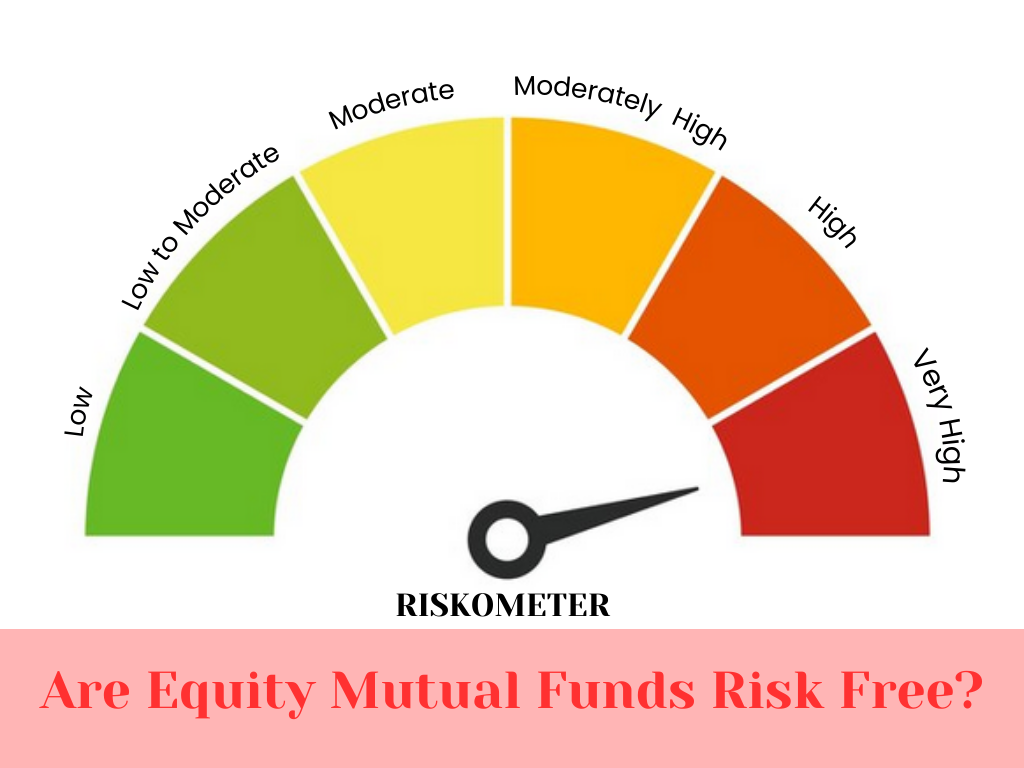

Equity funds are not risk-free. Equity funds invest in stocks of various companies listed on the stock exchanges, aiming to provide long-term capital appreciation. However, stocks are volatile and subject to market fluctuations. Therefore, equity funds carry a higher risk than debt funds.

The risk associated with equity funds can be classified into various categories such as market risk, sector risk, company-specific risk, and liquidity risk. Market risk refers to the risk of the overall stock market declining, which can lead to a decline in the value of the stocks held by the fund. Sector risk refers to the risk of a particular industry or sector underperforming. Company-specific risk refers to the risk associated with a particular company in which the fund has invested. Liquidity risk refers to the risk of not being able to sell the stocks held by the fund at a fair price due to lack of demand.

Investors should be aware of these risks before investing in equity funds. However, equity funds are considered to be suitable for investors who have a long-term investment horizon and are willing to take on higher risk for the potential of higher returns. It's important for investors to do their research and understand the risks associated with the fund before investing. It's also recommended to diversify the investment portfolio across different types of mutual funds to manage risk. It's always recommended to seek professional advice from a financial advisor before making any investment decisions.