In mutual funds are Balanced Funds risk-free?

No, balanced funds are not risk-free. Balanced funds invest in a mix of equities and debt instruments, and their returns are influenced by the performance of both equity and debt markets. While balanced funds offer a balance between growth and stability, they are still subject to market risk and other risks associated with equity and debt investments.

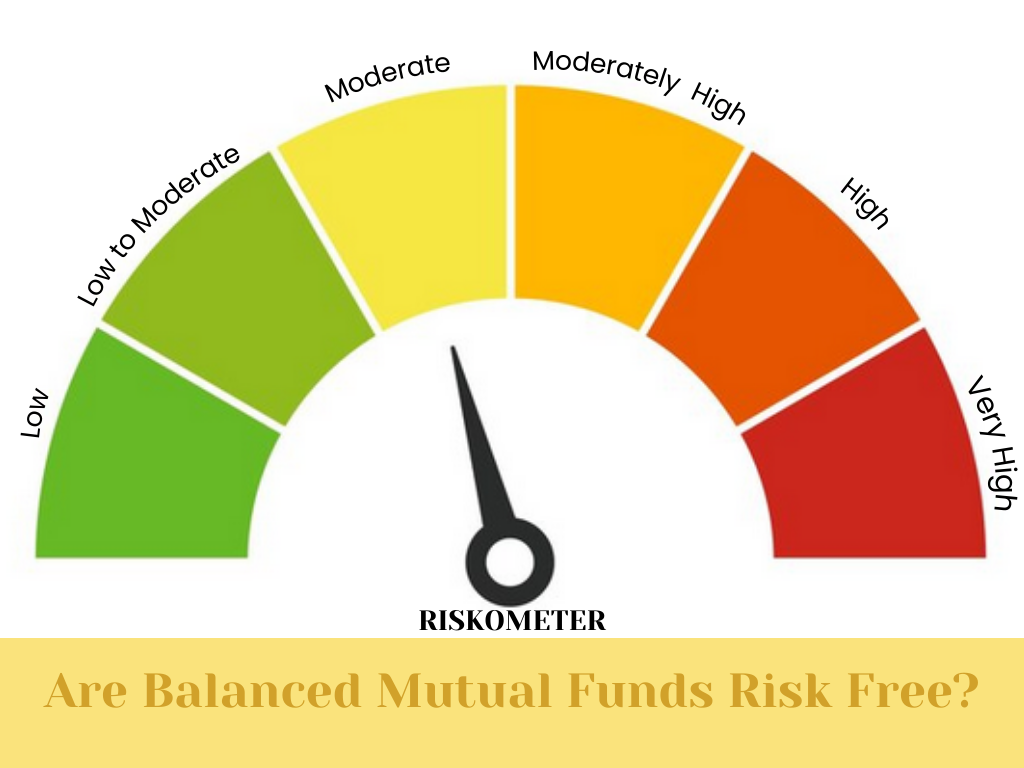

The level of risk associated with a balanced fund depends on the percentage allocation of equity and debt in the fund. For example, a fund with a higher allocation of equity may be more volatile and subject to higher risk than a fund with a higher allocation of debt.

Balanced funds are generally considered to be less risky than pure equity funds and more risky than pure debt funds. However, they still carry some level of risk, including market risk, credit risk, interest rate risk, and liquidity risk.

It's important for investors to understand the risks associated with balanced funds and to invest in them based on their risk tolerance, investment objectives, and investment horizon. It's always recommended to seek professional advice from a financial advisor before making any investment decisions.